Home Buyers Guide

Are you ready to take the leap into homeownership, but unsure where to start? Our home buyers guide cuts through the complexity, offering clear and concise steps to finding your dream home and securing a mortgage that fits your budget. You’ll learn how to sift through mortgage options, navigate loan approvals, and anticipate closing costs – all while maintaining financial stability. Let this guide provide the confidence you need to make informed decisions every step of the way.

Key Takeaways

Choosing the right mortgage involves assessing various types of loans, such as conventional fixed-rate loans, FHA loans, and VA loans, each with different benefits and suitability for homebuyers’ financial situations.

Preparing for mortgage approval requires maintaining a healthy credit score and a favorable debt-to-income ratio, as these factors are critically evaluated by lenders.

Homebuyers must budget for closing costs, which can range from 2% to 5% of the loan amount, as well as additional expenses like move-in costs and ongoing maintenance.

Table of Contents

Home Buyers Guide: Understanding the Home Buying Process

Buying a house is a significant financial decision that requires an in-depth understanding of the process. It’s not just about financial readiness but also emotional preparedness. Diving into the property market without a clear plan can lead to unnecessary stress. That’s where a detailed property wish list comes into play, allowing you to streamline your search based on property type, location, and features.

The home buying journey doesn’t end with finding the perfect property and making an offer. There is a crucial financial aspect that prospective homeowners often overlook – closing costs. These are fees paid at settlement, which finalize the property purchase. Don’t worry, first-time homebuyers; there are guides available to help you navigate these complexities and make the process less stressful.

Finding the right real estate agent

Finding a home that fits your wish list can be daunting. You need someone who understands your needs and helps you navigate the market – a real estate agent. A knowledgeable and experienced real estate agent can provide valuable insights into the local market and negotiate with sellers on your behalf. They play a significant role in influencing the outcome of your home buying process.

So, how do you choose the right real estate agent? Start by interviewing at least three agents. Ask them about their experience, strategies, and communication style. It’s also beneficial to get recommendations from individuals who have recently bought a home. This way, you get first-hand information about the agent’s performance and reliability.

Making an offer on a property

Once you’ve found your dream home and have a trusted real estate agent by your side, it’s time to make an offer. This process often involves negotiations, where both parties agree on the sale price and terms of sale. Your real estate agent’s experience and expertise become crucial here, guiding you through the process and helping you achieve favorable terms.

But what about the costs associated with closing the deal? It’s essential to understand that you can negotiate these costs as well. You can ask the seller for concessions, compare various lender rates, and apply for closing cost assistance programs. These strategies can help reduce the overall closing costs and make the home buying process more affordable.

Mortgage Loan Options: Finding the Best Fit

Choosing the right mortgage is as important as choosing the right home. The type of mortgage loans you choose can significantly impact your financial situation in the long run. From conventional fixed-rate loans to FHA and VA loans, each comes with its own set of benefits, suited for specific financial situations and real estate goals.

For instance, if you’re a low- to moderate-income consumer looking to buy homes in designated rural areas, the USDA mortgage program might be the right fit for you as it offers no down payment financing. On the other hand, if you’re in an expensive housing market or purchasing a high-cost property, a jumbo loan might be more suitable. However, keep in mind that it comes with higher down payment and stringent credit and debt requirements.

Conventional Fixed Rate Loans

Conventional fixed-rate loans are a popular choice among many homebuyers. They offer versatility and can be used for purchasing primary residences, second homes, or investment properties, often with down payments as low as 3%. These loans are divided into conforming loans, which adhere to the guidelines set by the Federal Housing Finance Agency, and non-conforming loans, which do not follow these standards.

One of the significant advantages of conventional fixed rate mortgages, compared to an adjustable rate mortgage, is the consistency they offer. Borrowers can enjoy stable monthly payments, making long-term financial planning more manageable. Moreover, if you’re able to make a 20% down payment, you can benefit from avoiding mortgage insurance, reducing your monthly expenses.

FHA Loans

FHA loans, insured by the Federal Housing Administration, are a favorable option for borrowers with lower credit scores. They require a minimum credit score of 580 and a minimum down payment of 3.5% to qualify. If the down payment is less than 20% of the home’s purchase price, borrowers must pay mortgage insurance premiums, which are typically included in monthly mortgage payments.

While FHA loans may come with additional costs like mortgage insurance, they provide an opportunity for those who might not qualify for conventional loans due to lower credit scores. Keep in mind that every mortgage option has its pros and cons, and it’s essential to understand them before making a decision.

VA Loans

VA loans are specifically designed for eligible service members and provide several benefits. They are guaranteed by the U.S. Department of Veterans Affairs, and key benefits include no mortgage insurance requirement and more flexible qualifying guidelines.

Perhaps the most significant advantage of VA loans is that they usually do not require a down payment, offering a substantial financial benefit to qualified borrowers. This feature can make homeownership more accessible to service members who may struggle to save for a large down payment.

Preparing for Mortgage Loan Approval

Getting approved for a mortgage loan involves more than just filling out an application. It requires careful planning, starting with:

Regular monitoring and ensuring the accuracy of credit reports.

Understanding how lenders assess credit scores.

Enhancing your chances of getting favorable loan amounts and rates.

Addressing credit score imperfections can be beneficial. Here are some steps to take before applying for preapproval:

Correct any errors on your credit reports.

Pay down debts to lower your credit utilization ratio.

Improve your debt-to-income ratio by paying off existing debts.

Taking these steps can help improve your credit score and increase your chances of getting preapproved.

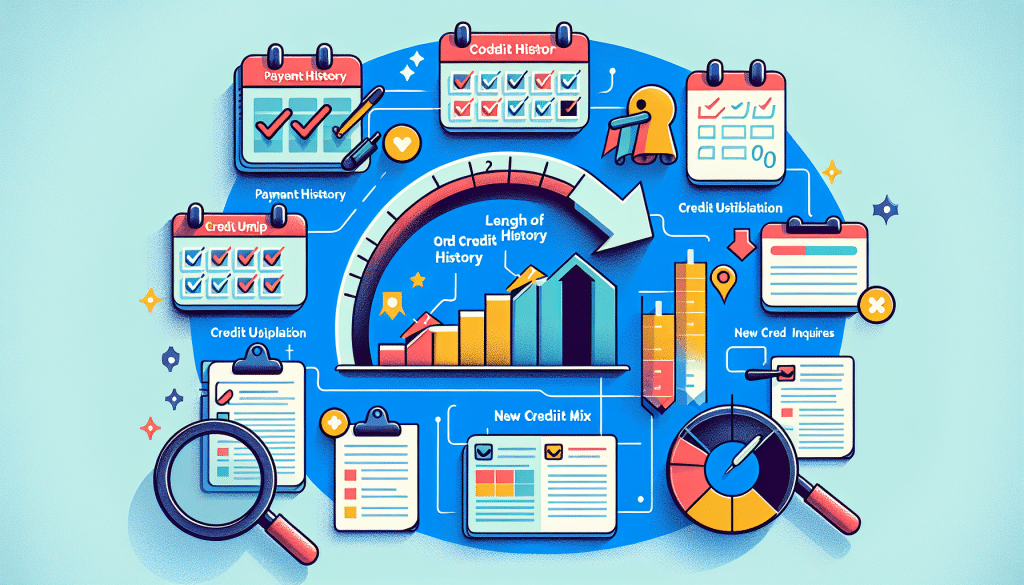

Credit Score Factors

Your credit score plays a significant role in securing a mortgage loan. Factors such as payment history, amounts owed, length of credit history, new credit accounts, and types of credit in use all contribute to your credit score.

Improving your credit score for mortgage approval involves strategies such as:

Ensuring on-time bill payments

Minimizing credit card balances

Not opening new credit accounts

Potentially becoming an authorized user on a responsible credit user’s account.

Clearing up inaccuracies on one’s credit report can also improve their credit scores. It’s advisable to review your credit report regularly and correct any errors promptly. A higher credit score can lead to better loan terms and lower interest rates, saving you money in the long run.

Debt-to-Income Ratio

In addition to your credit score, lenders also evaluate your debt-to-income ratio to assess your ability to manage payments and the risk of lending. A preferred debt-to-income ratio for loan approval is typically 36% or lower, including the new mortgage, which aligns with the 28/36 rule benchmark.

Reducing monthly debt obligations can lead to greater mortgage borrowing power. To improve the debt-to-income ratio, prospective borrowers are advised to maintain lower debt-to-credit ratios, and adhere to the 28/36 rule by keeping housing costs below 28% of gross monthly income.

Navigating the Mortgage Application Process

The mortgage loan process may seem daunting, but with proper understanding and guidance, it can be smoothly navigated. Here are the key steps:

Assess your finances and obtain preapproval.

Choose a lender.

Complete the mortgage application.

Provide all necessary documentation.

Wait for the lender to review and approve your application.

Complete the underwriting process.

Close on your mortgage and finalize the purchase of your home.

Obtaining preapproval is an essential early step in the mortgage application process that gives potential home buyers an estimate of how much they can borrow.

After obtaining preapproval, it’s time to submit the mortgage application, providing detailed financial information and documentation to the chosen mortgage lender. The final stages of the mortgage application process include underwriting and preparing for closing, where the assistance of a mortgage loan officer can be invaluable.

Remember, maintaining financial stability during this time is crucial to avoid any negative impacts on your creditworthiness.

Obtaining Preapproval

Receiving preapproval from mortgage lenders is a significant step towards homeownership. It indicates the lender’s willingness to lend money, confirming the buyer’s financial ability to obtain a mortgage, and increasing credibility with home sellers. Preapproval is more comprehensive than pre-qualification, as it involves a thorough check of the applicant’s financial status based on actual documentation.

Applicants are required to provide the following personal and financial documentation for preapproval:

Social Security numbers

Proof of income

Banking and investment account information

Tax forms

Pay stubs

It’s advisable to obtain preapproval letters from multiple lenders to compare rates and terms, with the assurance that several inquiries within a short time frame will only count as a single inquiry on a credit score.

Final Loan Approval Steps

Once you’ve obtained preapproval, the next step is final loan approval. This process involves completing the underwriting process, which includes the verification of the borrower’s:

income

assets

debt

property details

This stage requires a close examination of all the information you’ve provided during the application process.

It is crucial to remember that preapproval does not guarantee final loan approval. Changes in financial status or insufficient property valuation can affect the final mortgage decision. Therefore, maintaining financial stability and being truthful about your financial information is essential for a successful loan approval.

Estimating Monthly Mortgage Payments

Understanding how to estimate your monthly mortgage payments is an essential part of the home buying process. These payments typically consist of:

Principal

Interest

Local property taxes

Homeowner’s insurance

Private mortgage insurance (if the down payment is less than 20%)

Having a clear idea of your monthly mortgage payments helps in budgeting and financial planning. Consolidating principal, interest, taxes, and insurance into one monthly payment simplifies the payment process for homeowners. Online calculators can estimate mortgage payments by inputting variables such as:

Home price

Down payment

Loan term

Interest rate

Other relevant data

Principal, Interest, Insurance, and Taxes

A typical monthly mortgage payment has four key components:

Loan principal: This is the portion of the payment that reduces the remaining balance of the mortgage loan.

Loan interest: This is the cost incurred by borrowing the money.

Property taxes: These are taxes paid to the local government based on the value of the property.

Homeowner’s insurance: This is insurance that protects the homeowner in case of damage or loss to the property.

Each of these components contributes to the overall monthly mortgage payment.

Property taxes, charged by local governments, are typically included in the monthly payment and may be held in an escrow account, while homeowner’s insurance provides financial protection against loss or damage to the property. An escrow account may be established by the lender to collect and hold funds for property taxes and homeowner’s insurance, disbursing them when they come due.

Calculating Estimated Monthly Payments

The monthly mortgage payment is calculated using a formula that includes:

The principal loan amount

The monthly interest rate obtained by dividing the annual rate by 12

The total number of monthly payments over the life of the loan

Making a higher down payment on a home can result in better loan terms and a lower monthly payment, as it reduces the principal amount borrowed.

The loan term significantly impacts the monthly payment, with a longer loan term yielding a lower monthly payment. To estimate the monthly principal and interest payment, one should consider the loan amount, the interest rate after accounting for any down payment, and the loan term’s effect on the monthly payment.

Closing Costs and Additional Expenses

Closing on a house involves more than just the down payment and monthly mortgage payments. There are additional costs known as closing costs, which are separate from the property price and are paid at the end of the real estate transaction. These costs can include:

Appraisal fees

Inspection fees

Title search and insurance fees

Attorney fees

Loan origination fees

Prepaid property taxes and insurance

Escrow fees

Recording fees

These costs can range between 2% and 5% of the loan amount.

Common closing costs include:

Loan origination fee

Appraisal fee

Title search

Title insurance

Surveys

Taxes

Deed-recording fees

Lenders are required by law to provide a Loan Estimate that outlines your closing costs within three business days of receiving a mortgage application. To budget for these costs, you can review the Loan Estimate and use online calculators to estimate fees based on the property and loan details.

Understanding Closing Costs

Closing costs, as mentioned before, are additional fees that cover various expenses incurred during the home buying process. These costs typically range from 2% to 5% of the loan balance. They can be categorized into three main types:

Property-related costs, which include fees for appraisal, property taxes, and homeowner’s insurance.

Paperwork-related costs, which include fees for loan origination and notary services.

Mortgage application costs, which include fees for the mortgage application process.

By understanding these different types of closing costs, you can better prepare for the expenses associated with buying a home.

Buyers can get an accurate estimate of their prospective closing costs by using online calculators tailored for their specific state or region. Some common closing costs to consider include:

Loan origination fees

Appraisal fees

Title insurance fees

Attorney fees

Inspection fees

Escrow fees

Recording fees

Transfer taxes

For VA loans, there may be a VA funding fee at closing that ranges from 1.25% to 3.3%, and obtaining homeowners insurance effective on the closing date is typically a condition for mortgage approval.

Budgeting for Additional Expenses

Aside from the house price and closing costs, there are other expenses to consider when buying a home. Initial move-in expenses can be significant, encompassing costs for moving services, purchasing furniture and appliances, and utility setup fees.

Moreover, homeowners should also budget for ongoing maintenance and repairs, traditionally estimated at around 1% of the home’s purchase price on an annual basis. Planning for these additional expenses beyond the mortgage is crucial for financial stability and avoiding unexpected financial difficulties down the road.

Summary

In conclusion, buying a home is a significant financial commitment that involves more than just choosing a beautiful property. It requires understanding the mortgage process, knowing your mortgage options, preparing for loan approval, and budgeting for closing costs and additional expenses. With Elite Lending Service as your guide, you’re equipped with the knowledge to navigate this journey confidently. Remember, a well-informed homebuyer is the first step towards successful homeownership.

Frequently Asked Questions

What are the key factors influencing my credit score?

Your credit score is influenced by factors such as payment history, amounts owed, length of credit history, new credit accounts, and types of credit in use. These elements play a significant role in determining your overall creditworthiness.

What are the components of a monthly mortgage payment?

A monthly mortgage payment usually includes principal, interest, property taxes, homeowner’s insurance, and potentially mortgage insurance if the down payment is less than 20%. This covers the essential components of a typical mortgage payment.

What are closing costs?

Closing costs are additional fees that cover various expenses incurred during the home buying process, such as loan origination fee, appraisal fee, title search, title insurance, surveys, taxes, and deed-recording fees. These costs are over and above the purchase price of the property.

What is a preapproval letter?

A preapproval letter is issued by a mortgage lender to confirm the buyer’s financial ability to obtain a mortgage, indicating the lender’s willingness to provide funding.

What is the debt-to-income ratio?

The debt-to-income ratio is a metric used by lenders to evaluate a borrower’s ability to handle payments and the risk of lending. Lenders prefer a ratio of 36% or lower, including the new mortgage.